OKLAHOMA CITY THUNDER CUSTOM ASSOCIATION SWINGMAN JERSEY 2019-24 | THE OFFICIAL TEAM SHOP OF THE OKLAHOMA CITY THUNDER

OKLAHOMA CITY THUNDER 2019-24 ICON JERSEY LAPEL PIN | THE OFFICIAL TEAM SHOP OF THE OKLAHOMA CITY THUNDER

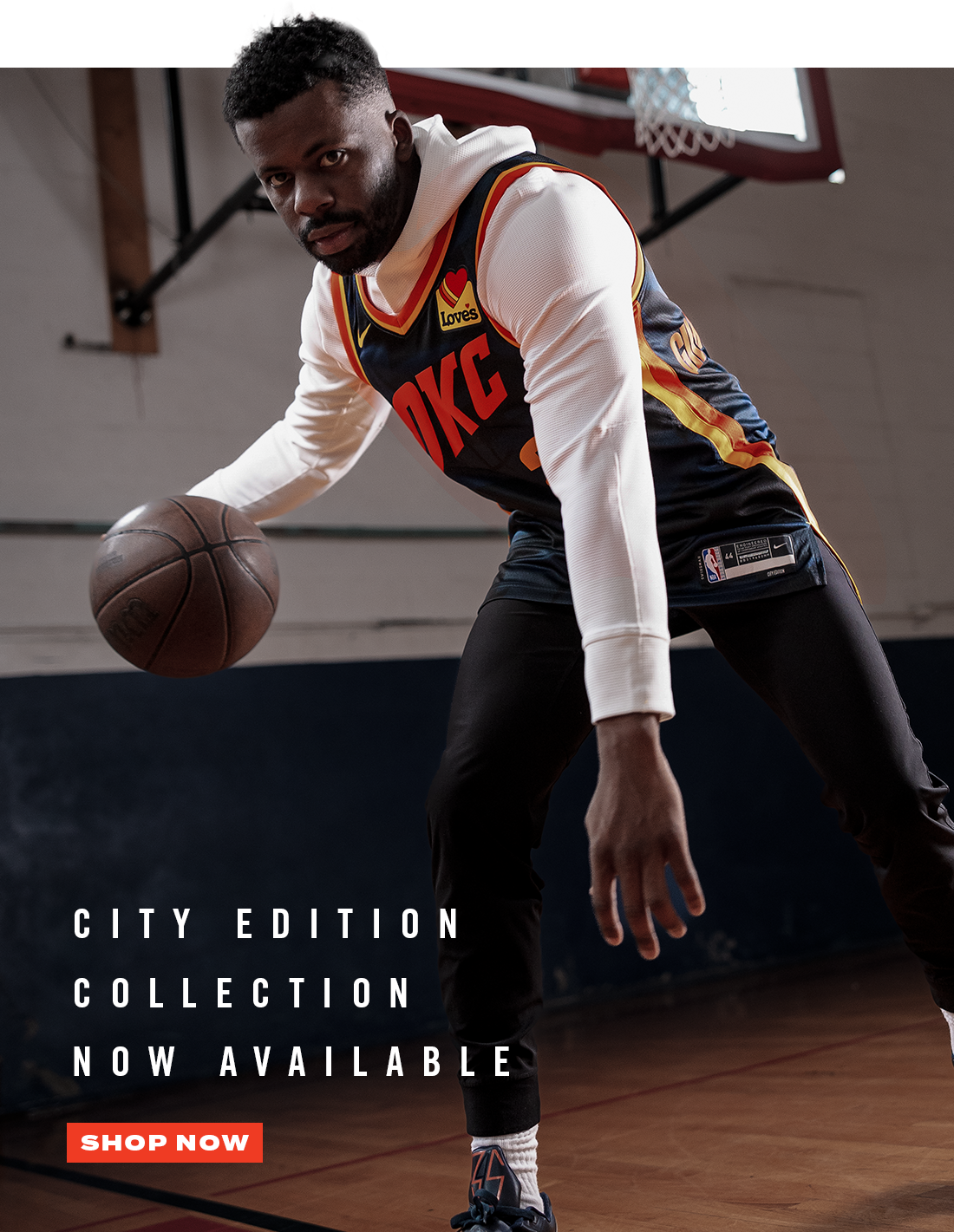

Men's Oklahoma City Thunder Shai Gilgeous-Alexander Nike Black 2020/21 Swingman Player Jersey - City Edition

OKLAHOMA CITY THUNDER CUSTOM ASSOCIATION SWINGMAN JERSEY 2019-24 | THE OFFICIAL TEAM SHOP OF THE OKLAHOMA CITY THUNDER

OKLAHOMA CITY THUNDER CUSTOM ICON SWINGMAN JERSEY 2019-24 | THE OFFICIAL TEAM SHOP OF THE OKLAHOMA CITY THUNDER

Men Is Okc Thunder Mike Muscala 2020 21 Black City Jersey in 2023 | Justin jackson, Frank jackson, Okc thunder

Adidas Oklahoma City Energy FC 2020 Third Released - Paying Tirbute To Victims Of OKC Bombing - Footy Headlines